APP2APP integration User-Authentication

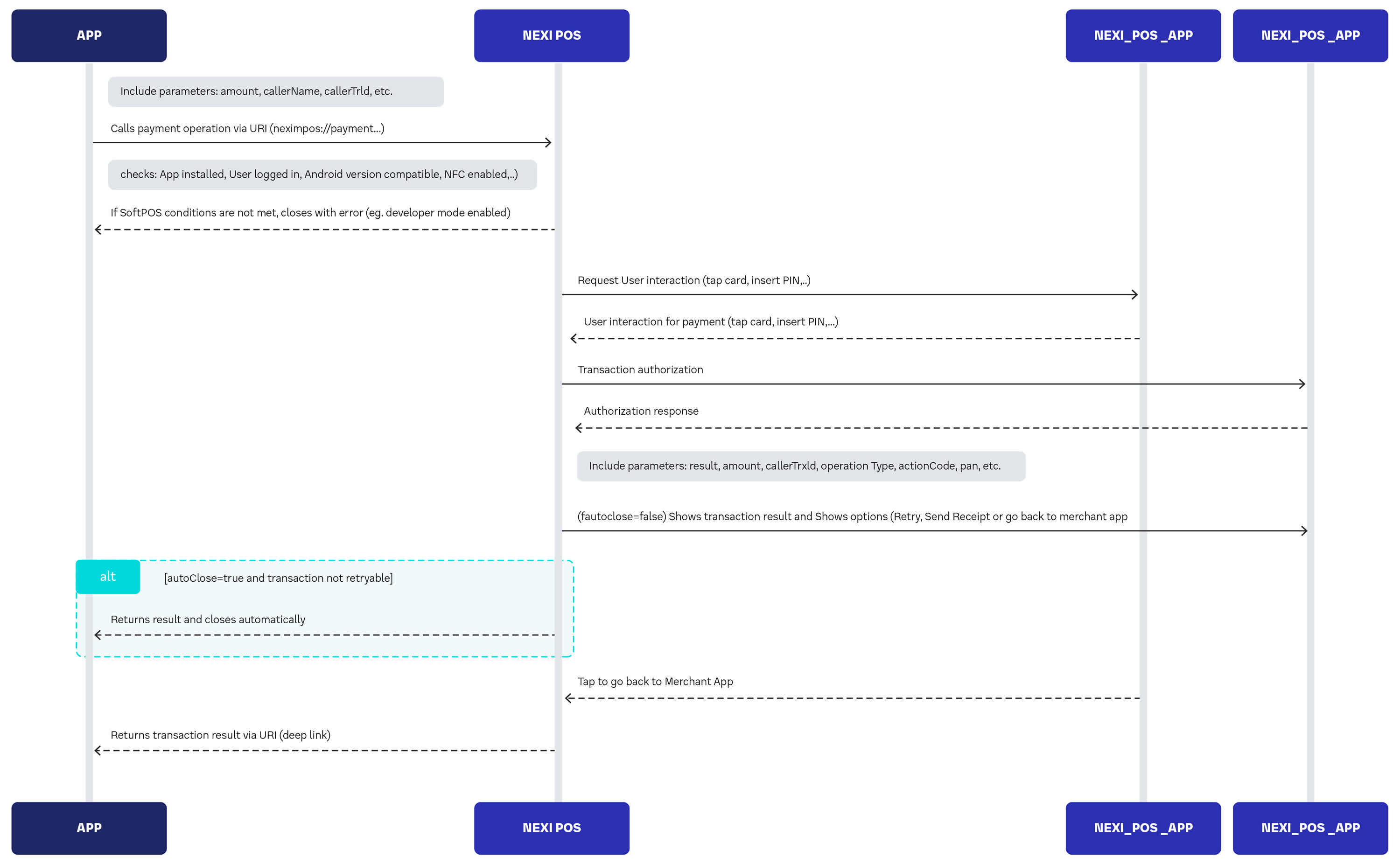

SoftPOS

Overview SoftPOS

The App2App SoftPOS integration enables merchant applications to initiate in-person payments by securely invoking the Nexi SoftPOS app through a URI scheme (neximpos://payment...). The invocation must include key parameters such as amount, callerTrxId, and callerName. Upon receiving the request, the Nexi POS application performs a series of pre-checks, including validation of app installation, user authentication (log-in), device compatibility (e.g., Android version), and NFC availability. If any of these requirements are not met (e.g., developer mode enabled or NFC disabled), the operation is aborted with an error. If the environment is valid, the user is prompted to complete the transaction via contactless card interaction and PIN entry (if required). The outcome is returned to the Nexi POS app. Depending on the autoClose configuration, the transaction result is either shown within the POS app and manually back to the merchant App via a CTA or automatically returned to the invoking merchant app via deep link (with this set up the receipt can not be sent via NexiPOS) , including all relevant metadata such as result, operationType, actionCode, and masked pan, exc.

Prerequisites SoftPOS

Before launching payments using app2app communications, the smartphone must be configured as follows:

- The user must download and install the Nexi POS application from Apple App Store or Google Play Store (according to the smartphone O.S.)

- The user must login and change the password (mandatory at the first access)

- The smartphone must have Android operating system >= 9 and be equipped with NFC. If the conditions above are not satisfied, the Nexi POS app will close returning an error code see here for more information.

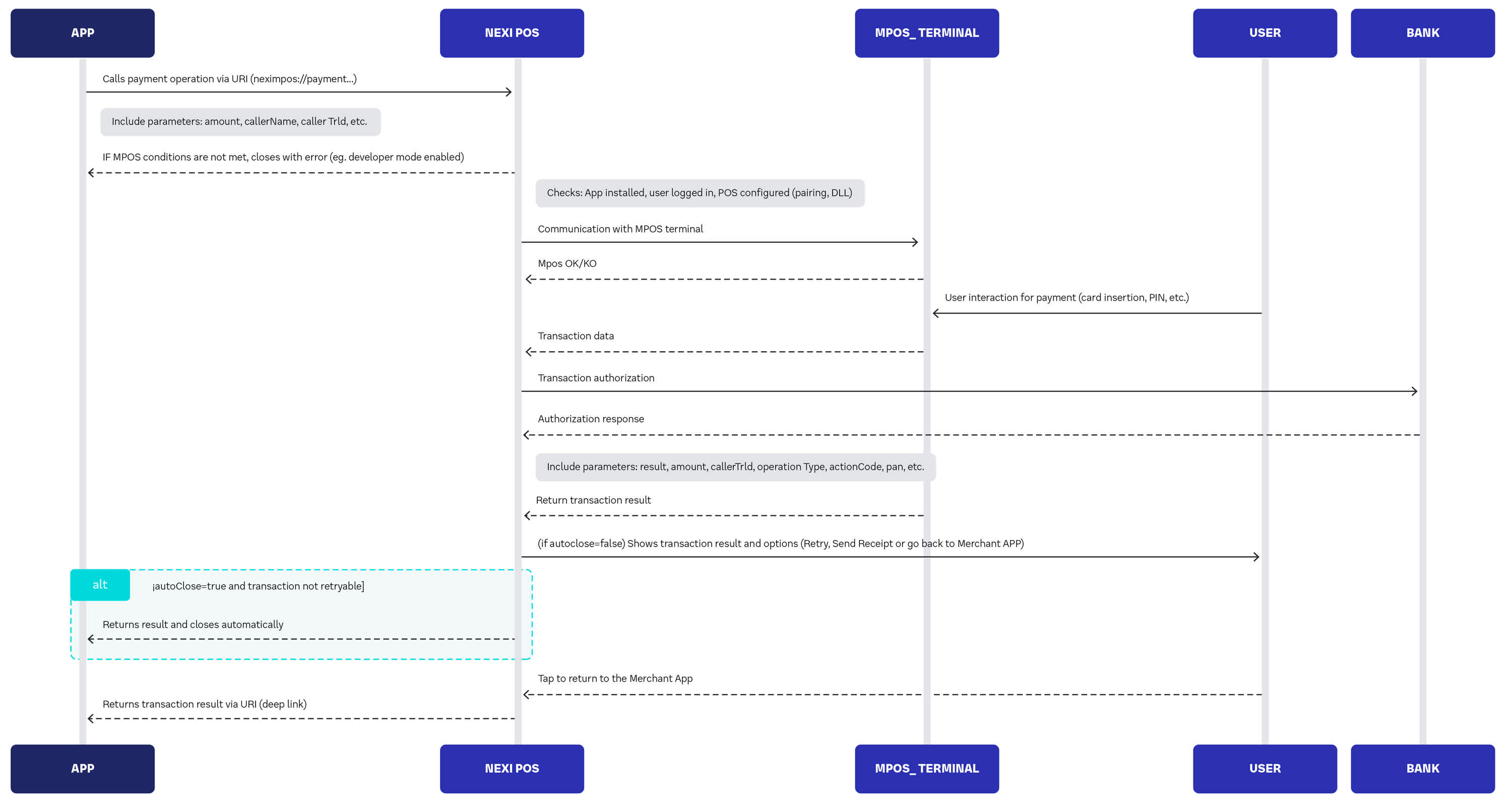

MobilePOS

Overview MobilePOS

App2App MPOS Integration The App2App MPOS integration is designed to support external, paired MPOS terminals for in-app payment acceptance. Merchant applications initiate the payment flow by invoking the Nexi POS application via a URI call, embedding mandatory transaction metadata (e.g., amount, callerTrxId, callerName). The Nexi POS app validates prerequisites such as user authentication, proper MPOS terminal configuration (pairing and driver installation), and device compatibility. Once verified, the app establishes communication with the MPOS terminal to enable card-present user interaction (e.g., card insertion, PIN entry). The transaction data is routed through the Nexi system for bank authorization. The response, including parameters like result, operationType, actionCode, amount, and masked pan, is processed by the Nexi POS. Based on the autoClose parameter, the result is either returned directly to the merchant application via deep link or displayed in the POS interface with actionable options (e.g., retry, send receipt, or return to the merchant app). This flow ensures a robust and secure integration path for managing payment lifecycle events in MPOS environments.

Prerequisites MobilePOS

Before launching payments using app2app communications, the POS must be configured as follows:

- The user must download and install the Nexi POS application from Apple App Store or Google Play Store (according to the smartphone O.S.)

- The user must login and change the password (mandatory for the first access)

- The user must configure the POS, doing Bluetooth pairing and first DLL. If these steps are not properly followed, the Nexi POS app will close returning an error code see here for more information.

SoftPOS - MobilePOS

If the user has both a MobilePOS and softPOS terminal ids, checks will be made only when the user has selected the payment method (mPOS or softPOS).

According to the selected method, will be carried out the above checks.

Many operations expect the terminal id (TID) as input parameter. Since user is provided with two TIDs, Nexi POS app will expect to receive softPOS TID for softPOS operations and mPOS TID for mPOS operations.