Overview Cloud-Authentication

Overview

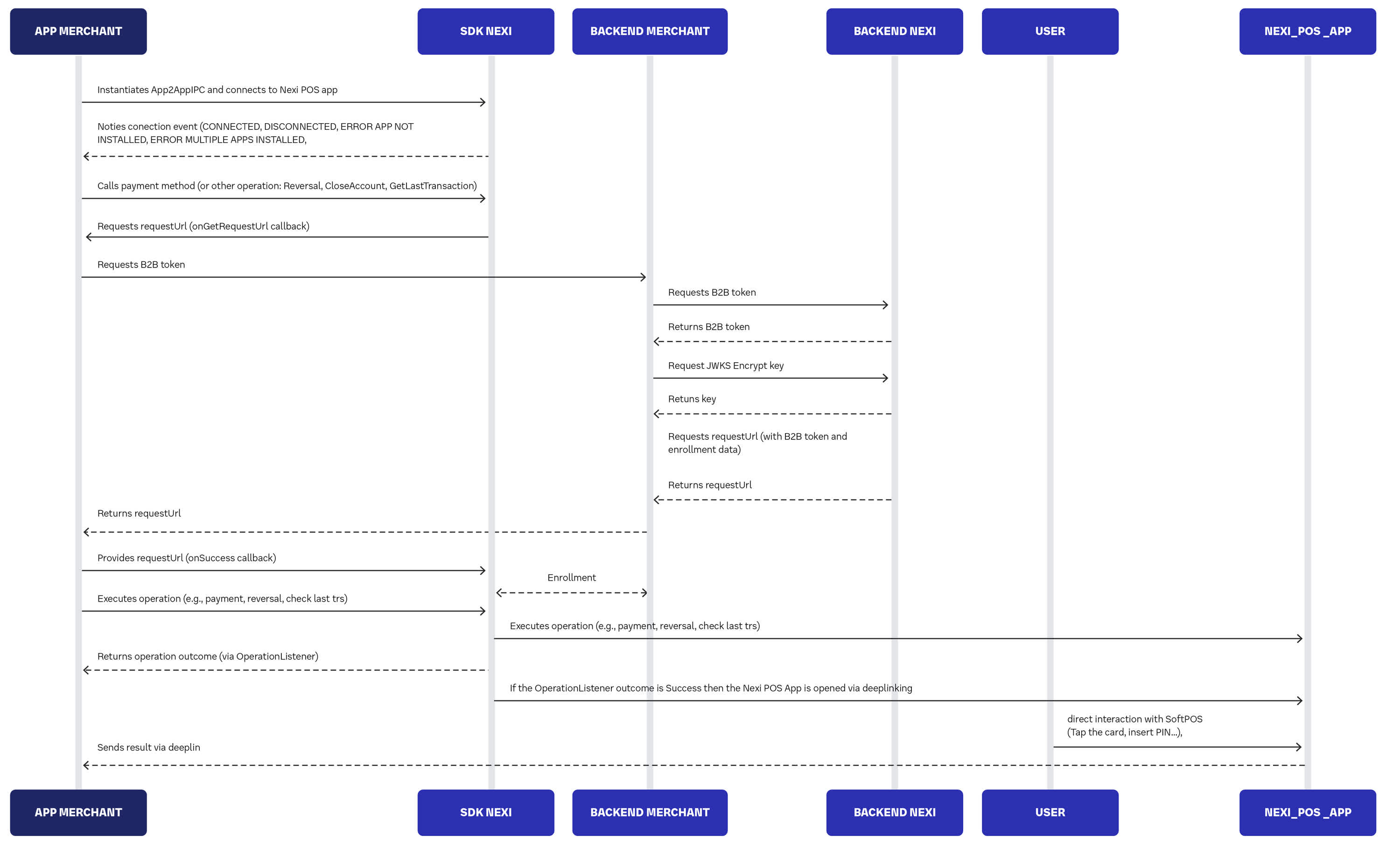

Softpos cloud-authentication

This diagram shows the sequence for an App2App integration leveraging a SoftPOS solution, where the merchant's mobile device itself functions as the POS terminal.

- App Merchant (physically installed on the device)

- Nexi POS ( App available in the play store or downloaded in .apk or .aab formats)

- Backend merchant ( the BE has to run server-side)

- Backend Nexi

- SDK Nexi

Flow:

-

Backend Authentication: The Backend Merchant communicates with the Backend Nexi to first request and receive a B2B (Business-to-Business) token and an encryption key (JWKS Encrypt key), then the BE Merchant prepares the PAR API call to get the requesturi.

This component is then passed back through the SDK Nexi to the APP Merchant, likely to facilitate the transaction process on the merchant's application. -

Setup and Request: The APP Merchant's application initiates by installing the App2AppIPC and connecting to the New POS App via the SDK Nexi. The SDK calls the callback ongetrequesturi to start the enrollment flow BE side. Once the SDK returns the requesturi, meaning that the enrollment flow ended correctly, The APP Merchant then calls a payment method or another operation through the SDK.

-

Transaction Execution via SoftPOS Terminal: The BACKEND NEXI executes the requested operation (e.g., payment). In a SoftPOS context, this implies the Nexi POS App on the merchant's device handles the card reading (e.g., via NFC) and user interaction directly.

- Transaction data is captured and sent to the Bank for authorization.

- The Bank returns an authorization response.

- The outcome, including details like the result and amount, is sent back to the Merchant APP. This path also allows for other operations like reversals.

- Result Communication: Finally, the Nexi POS App sends the transaction result, including details like amount, directly to the APP Merchant using a deeplink.

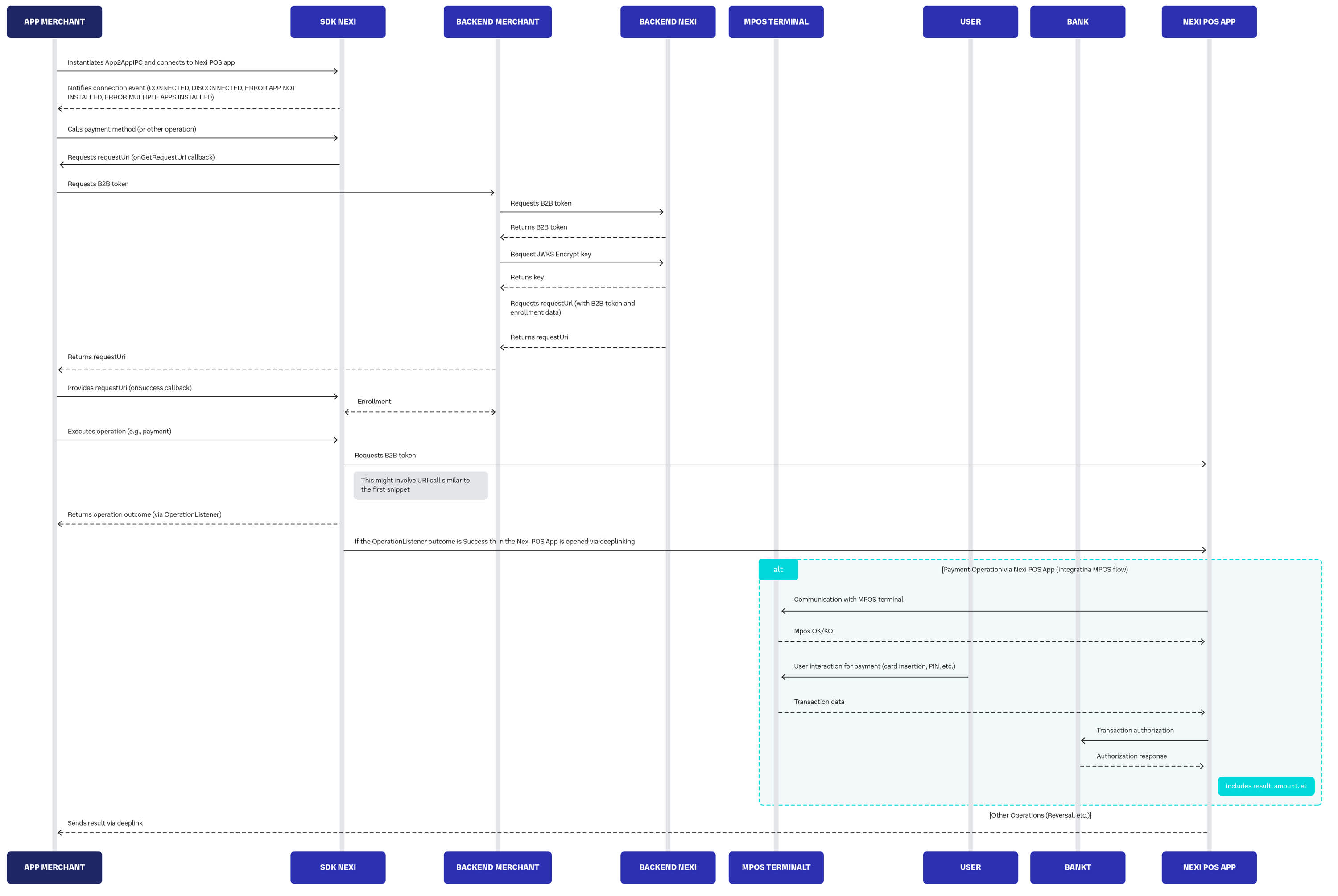

Mpos cloud-authentication

This diagram illustrates the sequence of operations for an App2App integration using a physical Mobile Point of Sale (mPOS) terminal. Entities:

- App Merchant (physically installed on the device)

- Nexi POS ( App available in the play store or downloaded in .apk or .aab formats)

- Backend merchant ( the BE has to run server-side)

- Backend Nexi

- SDK Nexi

- Mobile POS ( physical hardware)

Flow:

-

Backend Authentication: The Backend Merchant communicates with the Backend Nexi to first request and receive a B2B (Business-to-Business) token and an encryption key (JWKS Encrypt key), then the BE Merchant prepares the PAR API call to get the requesturi.

This component is then passed back through the SDK Nexi to the APP Merchant, likely to facilitate the transaction process on the merchant's application. -

Setup and Request: The APP Merchant's application initiates by installing the App2AppIPC and connecting to the New POS App via the SDK Nexi. The SDK calls the callback ongetrequesturi to start the enrollment flow BE side. Once the SDK returns the requesturi, meaning that the enrollment flow ended correctly, The APP Merchant then calls a payment method or another operation through the SDK.

-

Transaction Execution via mPOS Terminal: The Backend Nexi orchestrates the execution of the payment. A distinct flow sequence details the actual transaction processing involving the physical hardware:

- The Nexi POS App, which integrates the mPOS flow, communicates with the MPOS Terminal.

- Further interactions occur with the MPOS terminal (e.g., status updates like More OK/KO).

- The User interacts directly with the MPOS Terminal for payment (e.g., card insertion, PIN entry).

- Transaction data is captured and sent to the Bank for authorization.

- The Bank returns an authorization response.

- The outcome, including details like the result and amount, is sent back to the Merchant APP. This path also allows for other operations like reversals.

- Result Communication: Finally, the Nexi POS App sends the transaction result, including details like amount, directly to the APP Merchant using a deeplink.