Manage Payment Intstruments

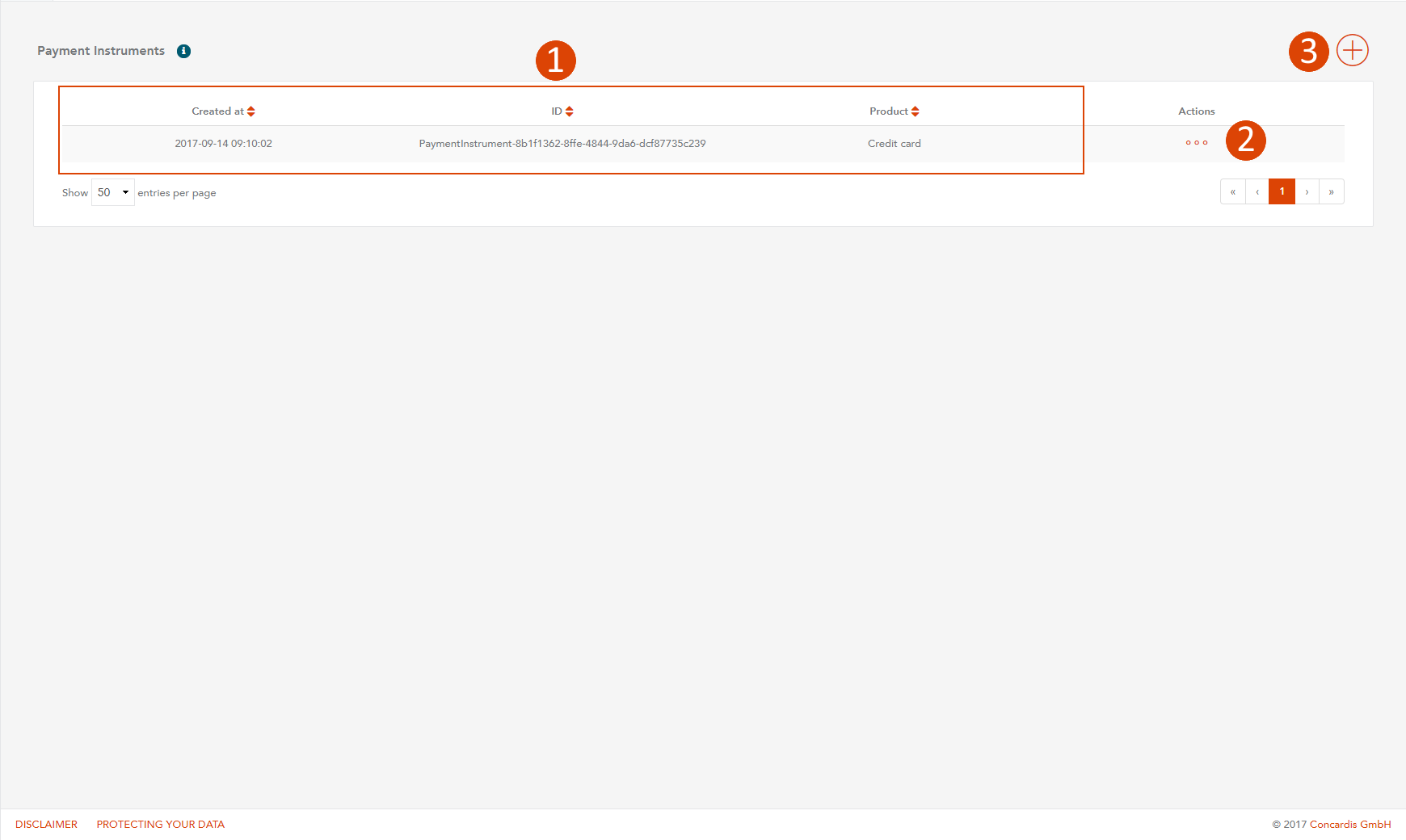

Payment Instruments

- General information about your payment instruments can be found here.

- To edit an existing payment instrument use this button.

- If you'd like to add a new payment instrument use this button.

Manage Payment Instruments

Navigation

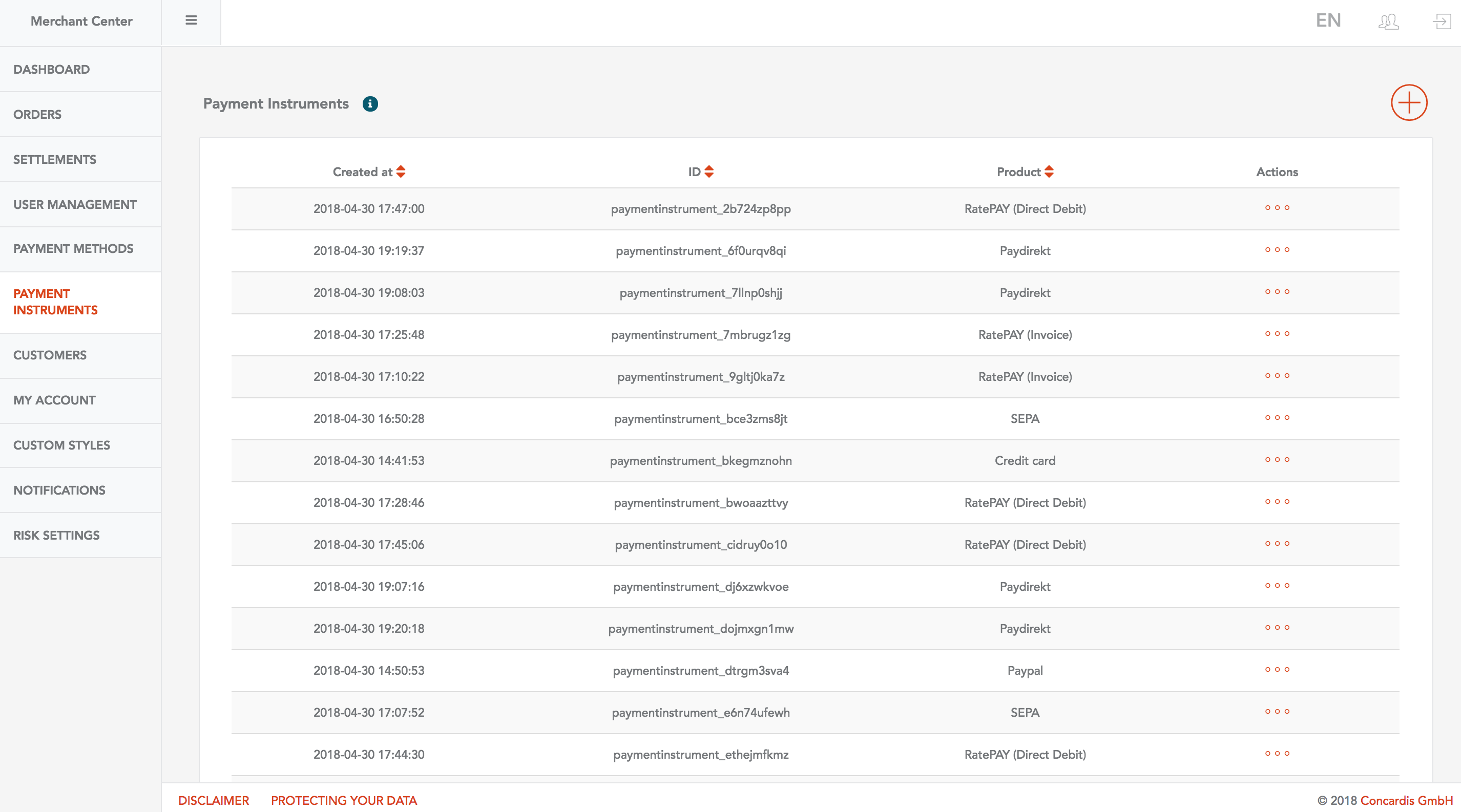

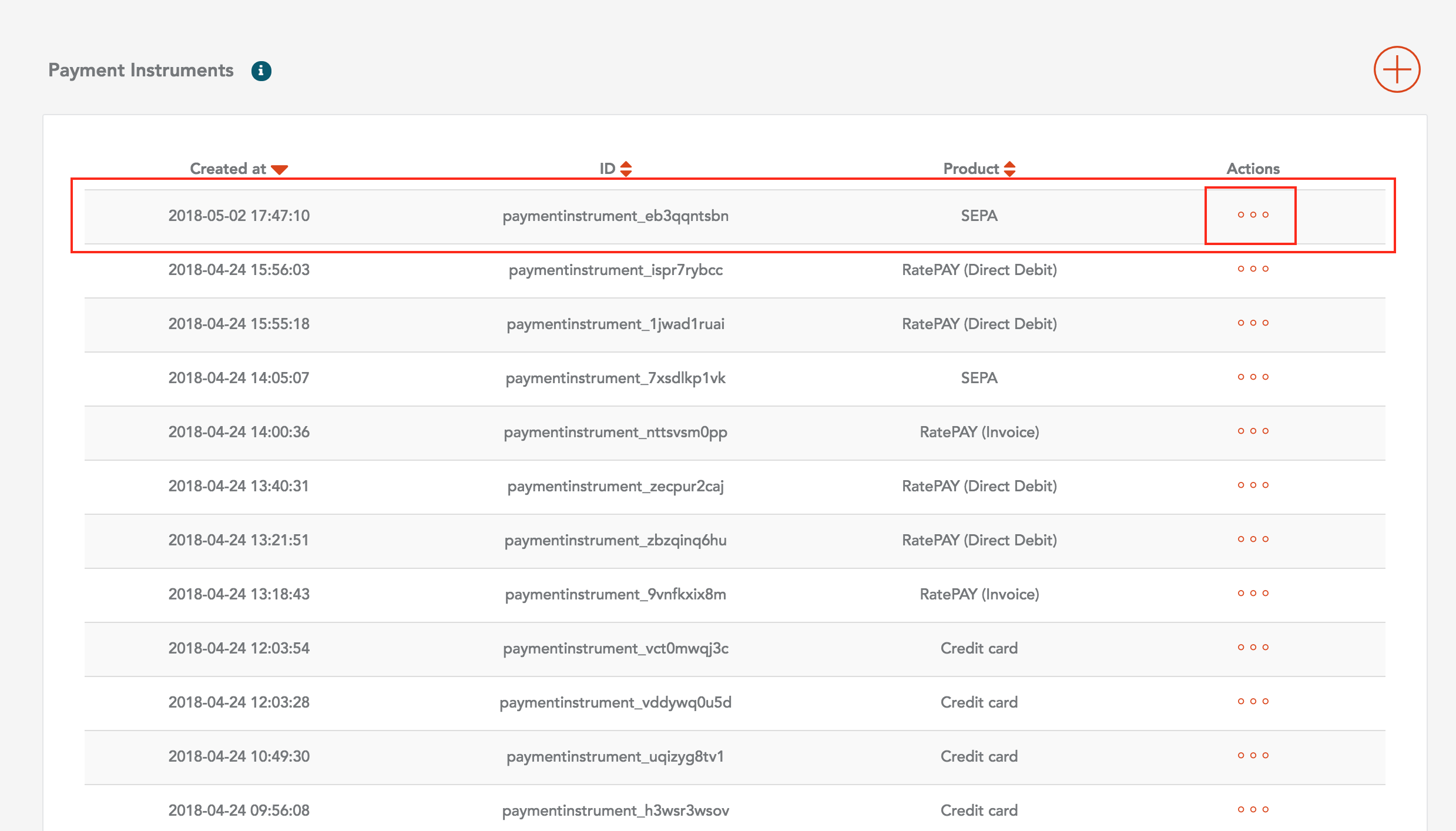

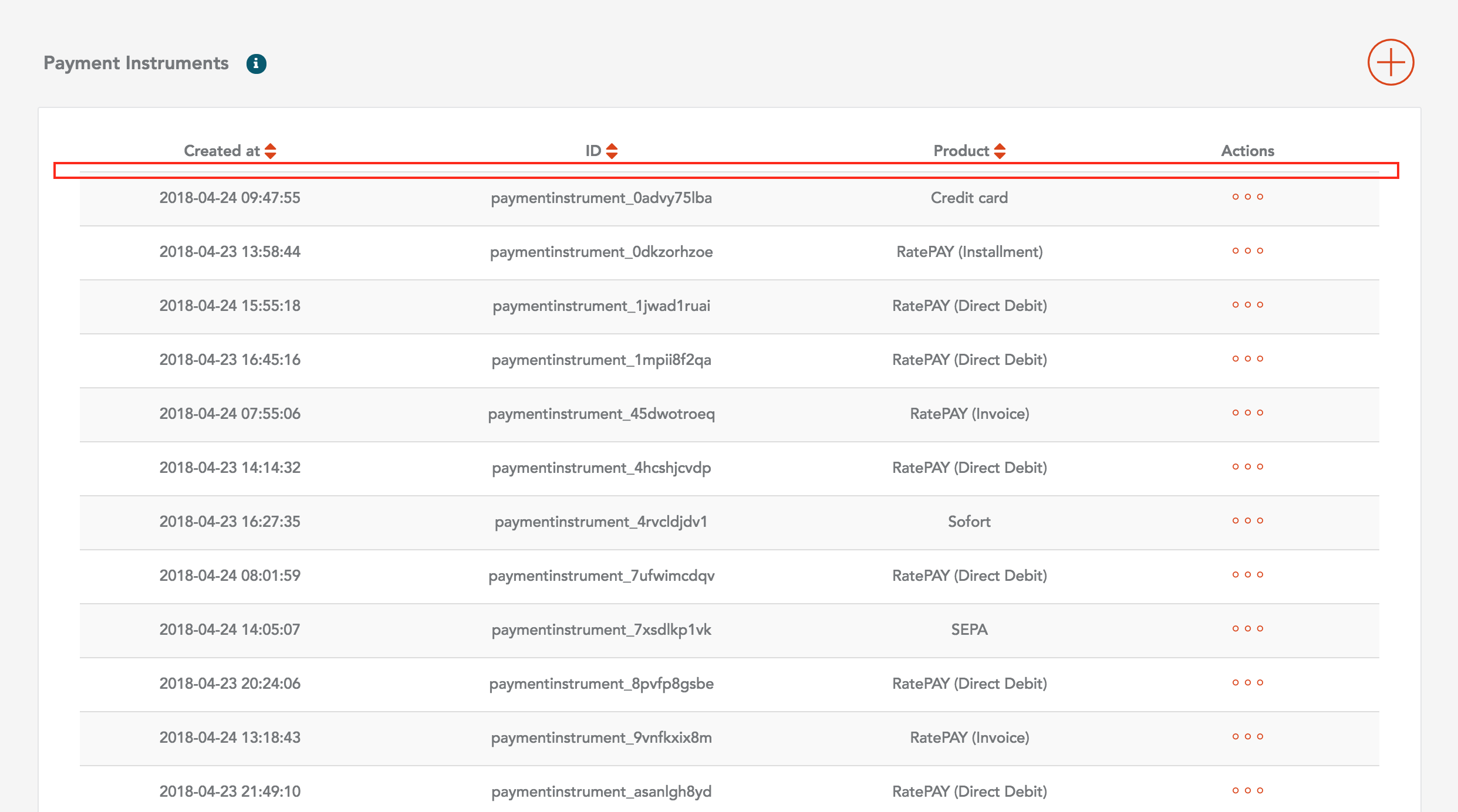

Payment Instruments information can be found in "Payment Instruments" menu item. After you click on menu item you must see Payment Instruments list.

Create

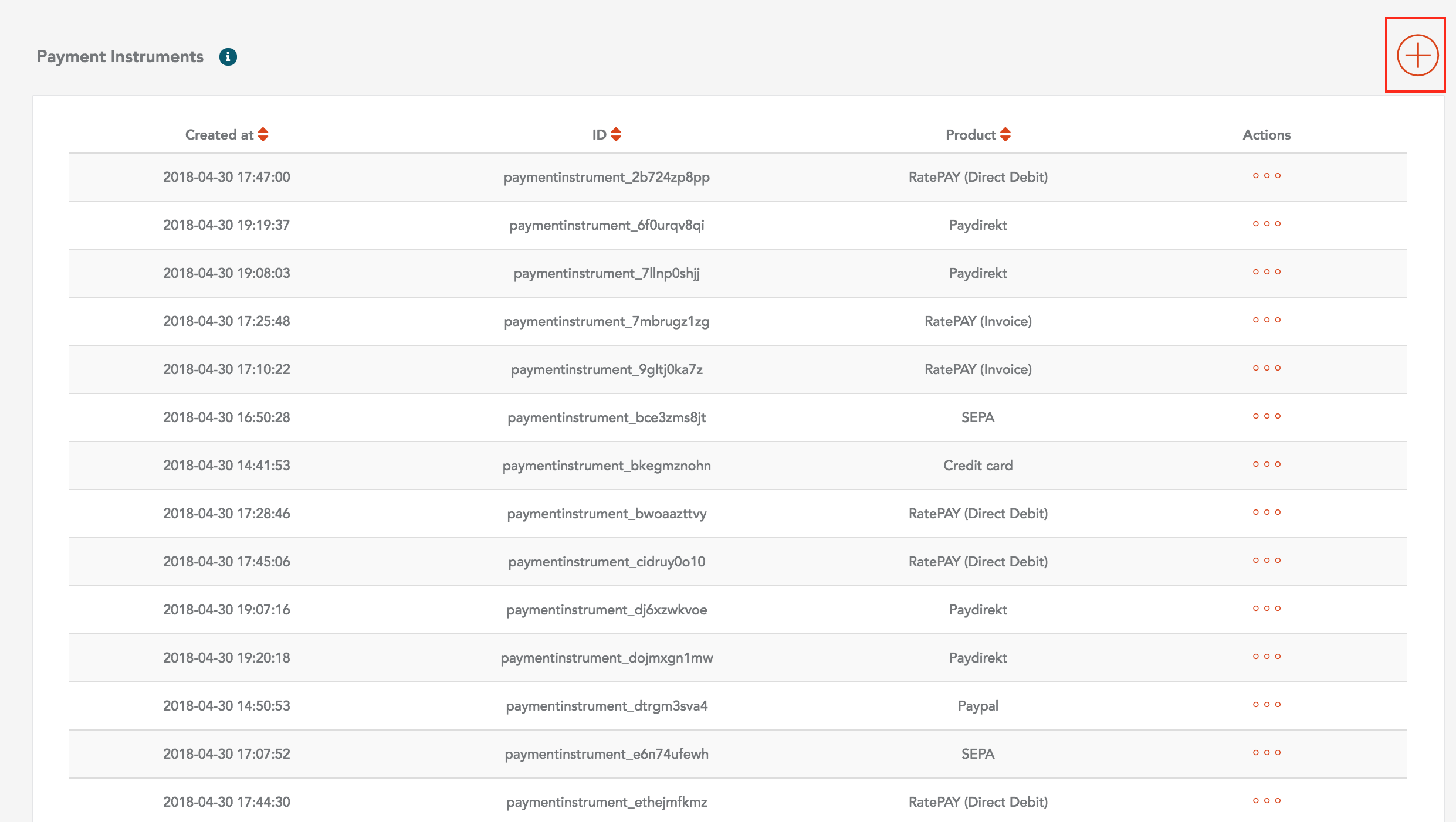

To create customer, you must click on "Plus" button on top right corner:

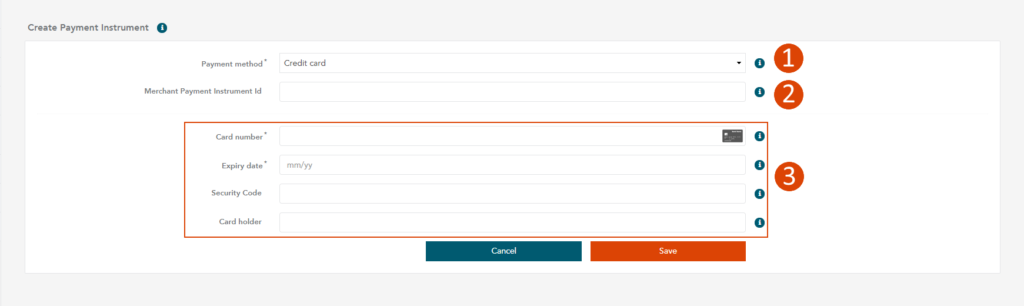

- You can select the payment method in the first field.

- You can add your custom ID in the "Merchant Payment Instrument Id" field.

- Add the credit card information here.

It will open new window:

Details

You can see detailed Payment Instrument information if you click on "Actions" button for selected Payment Instrument:

Delete

If you want to delete Payment Instrument you must select "Delete Payment Instrument" button on the top right corner.

You will see modal window with for confirmation of deleting: After you confirm, the Payment Instrument will be deleted from the Payment Instruments list.

Payment Instrument Patch

General Info

When processing credit card transactions you may want to ask for additional verification not only on the first transaction for which this is mostly mandatory but also for any subsequent transaction with a saved card (payment instrument).

There are two major additional verification methods that may present the customer with additional security challenge - cvc and 3d secure.

Both challenges require a code that should be only known to the cardholder and is used in the processing.

The CVV/CVC code (Card Verification Value/Code) is located on the back of the cardholder’s credit/debit card on the right side of the white signature strip.

3d secure code is only known to the cardholder and should be only submitted via an issuer specific page.

The Payengine allows merchants to create payment instruments in order to process recurring payments for the same credentials (card number). Even though the merchant can decide to additionally ask for cvc and/or 3d secure on each subsequent cardholder present transaction as well.

In order to do so the merchant should ask the cardholder to enter his cvc on each subsequent transaction and patch the already existing payment instrument with this value.

When the cvc is successfully patched and the order is submitted for processing according to the merchant settings the transaction may result in additional 3d secure asynchronous process.

Usecase

Given:

You have a previously used payment instrument.

Usecase:

On creating the recurring payment you need to collect the cvc via one of the following options:

- Widget as a bridge PayEngineWidget.initAsInlineComponentPiUpdate(container, publishableKey, paymentInstrumentId, optionalParameters, resultCallbackPatchPi);

- Bridge iframes solution