Reason codes

This guide outline the different reason codes that could occur for card scheme transactions and the different types of declines.

Overview

Reason codes are used as a way for the card issuer to provide for what and why a payment transaction might not go through. This can help you to understand on how and what you can advise your consumer to do.

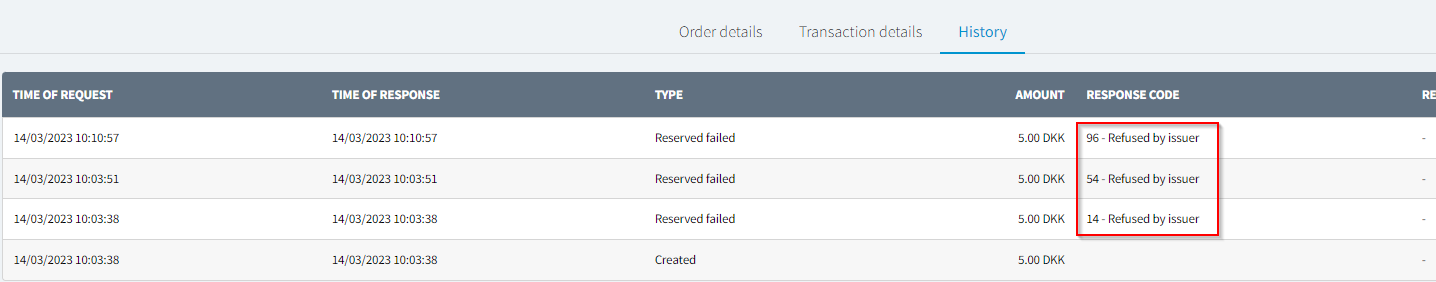

These codes are shown when logged into your Portal account and can be seen under the Declined overview of payments.

Unfortunately, most declines are categorized by the card issuer as “generic”. This means that it is not always possible for Checkout to know exactly why a payment was declined. If all of the card information seems correct, it is best to have your consumer contact their card issuer and ask for more information.

For privacy and security reasons, card issuers can only discuss the specifics of a declined payment with their cardholders. This means that Checkout cannot help with this.

Types of declines

There exists two types of declines that can occur on card scheme payments; soft declines and hard declines.

This section describes the differences between the two, on how to proceed and what it means in conjunction with the reason codes.

Soft decline

A soft decline occurs when the issuing bank approves the payment, but the transaction fails at some other point in the process.

Examples of when a soft decline may occur could be because:

- Insufficient funds

- Card activity limit exceeded

- Failures due to either system, technical, or infrastructure issues

- Expired cards

You can check all the soft declines in the reason codes table here.

Hard decline

A hard decline is when the issuing bank does not approve the payment. In other words, hard declines are permanent authorization failures and should not be retried.

Examples of when a hard decline may occur could be because:

- Possible fraud

- Insufficient available credit

- Lost or stolen card

You can check all the hard declines in the reason codes table here.

Account verification

If you are a subscription merchant and you are verifying cards with account verification, and it fails with a hard decline reason code then the consumer needs to be contacted so they can update their card details.

If you are a subscription merchant and you are verifying cards with account verification, and it fails with a soft decline reason code then you are allowed to attempt a charge.

You can read more about subscriptions from here.

Descriptions of reason codes

The following table outlines all of the reason codes for each of the card schemes including the decline type, a description of what it means and what next steps could be done for either you or the consumer to proceed with a payment:

Please note that the following reason codes does not apply for American Express as of now.

In the Type column, soft declines are indicated as SD and hard declines as HD. In the Next steps column, you can suggest on how the consumer can proceed with the transaction.

| Code | Scheme | Type | Description | Additional info | Next steps | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 00 | Visa, Mastercard | - | The transaction is approved and completed successfully | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 01 | Visa, Mastercard | SD | The bank issuer declined the transaction | The consumer should contact their issuing bank to clarify the situation | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 03 | Visa, Mastercard | SD | Refer To Card issuer | The consumer needs to contact their card issuer for more information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 04 | Visa, Mastercard | HD | Pick up card (no fraud) | The consumer needs to contact their card issuer for more information | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 05 | Visa, Mastercard | SD | Do not honor | The issuing bank is unwilling to accept the transaction | Ask the consumer for another card to complete the transaction or ask them to contact their bank for more details | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 06 | Visa, Mastercard | HD | Error | When the code occurs for a one-time transaction, do not rerun the card and do not provide any more goods or services to the cardholder. For the recurring or scheduled transaction, ensure that the card was not incorrectly flagged as fraudulent | Ask the consumer to contact their bank or update their payment details with a new card | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 07 | Visa, Mastercard | HD | Pickup card, special condition | The card issuer requests to retain the card, which can be due to a suspected counterfeit or stolen card. | Ask the consumer to contact their bank or update their payment details with a new card | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

12 | Visa, Mastercard | HD | Invalid Transaction | The issuer does not allow this type of transaction on this card/account. Make sure that payments are correctly configured. | Ask the consumer to contact their bank or update their payment details with a new card | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 13 | Visa, Mastercard | SD | Invalid Amount | The card issuer has declined the transaction because of an invalid format or field | The consumer should retry or use another payment method | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

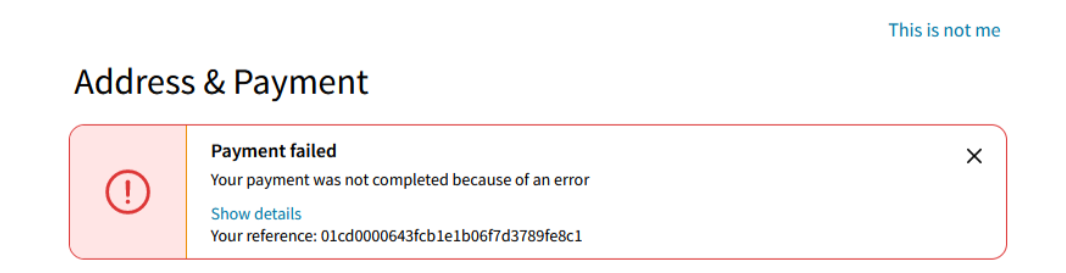

Checkout window

Please be aware that it is not possible for Checkout to show which specific error code and description is occurring in the checkout window.

This is to avoid and ensure any fraud from happening. This is why error messages are shown as this:

Testing

If you want to try and test for different flows and scenarios with the card schemes in the checkout demo store in connection with these reason codes, you can read more about the following below: